5 Types of Adjusting Entries

The set of journal entries involved starting from purchase to sale of goods under perpetual inventory system is given below. Adjusting entries make sure that your financial statements only contain information relevant to the particular period of time youre interested in.

What Are Adjusting Entries Definition Types And Examples

When reconciling balance sheet accounts consider monthly adjusting entries relating to consolidation.

. 5 Examples for Adjusting Entries. Intercompany transactions include adjusting entries for profit elimination relating to general ledger accounts like intercompany revenues accounts receivable fixed assets inventory accounts payable and cost of sales. In the ledger the wages account is debited by 11320 the transport account by 4180 the stationery account by 8660 the staff tea account by.

After investigating various types of partnerships you both agree a general partnership is the best choice. When you post intercompany journal entries the post program creates an adjusting entry in the F0911 table to balance the domestic amounts AA ledger of the non-base currency accounts. The base currency account is typically the account on the.

Revenue from sales revenue. The remaining 6000 amount would be transferred to expense over the next two years by preparing similar adjusting entries at the end of 20X2 and 20X3. The total 40200 is shown on the credit side of the cash book bank column as payment.

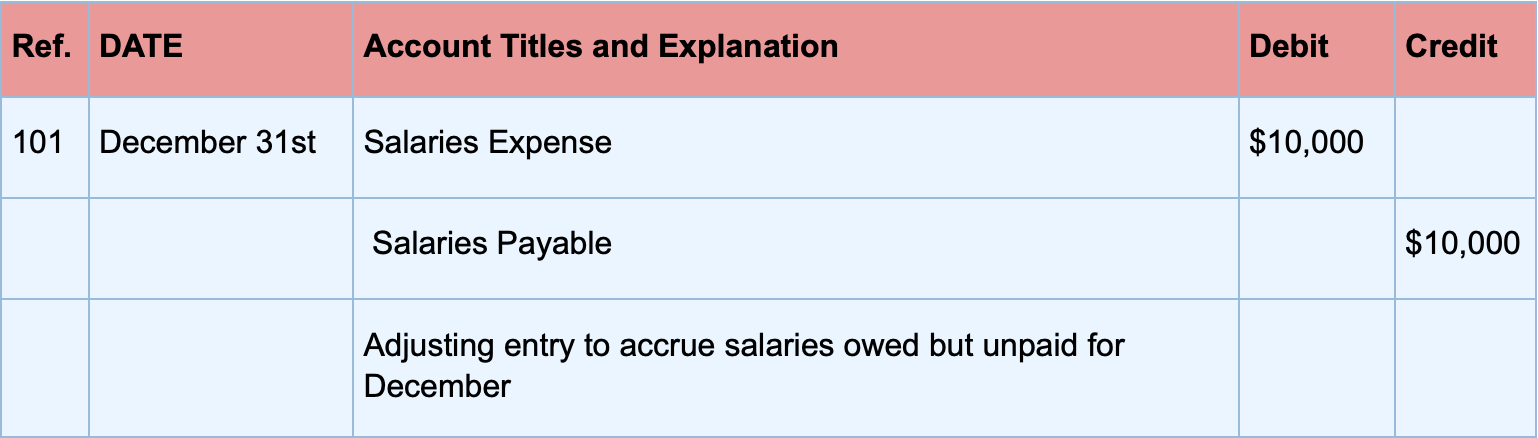

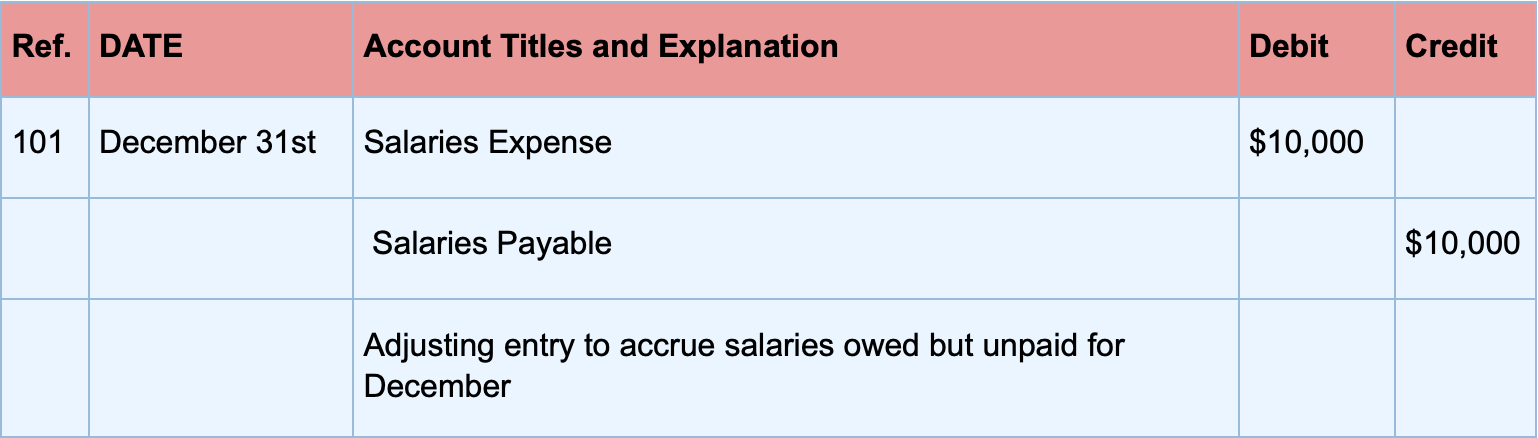

A typical example is credit sales. It has 3 major types ie Transaction Entry Adjusting Entry. The five types of adjusting entries.

Operating Activities The company sold 500 units of merchandise at the price of 11000. Once youve made the necessary correcting entries its time to make adjusting entries. Typical financial statement accounts with debitcredit rules and disclosure conventions.

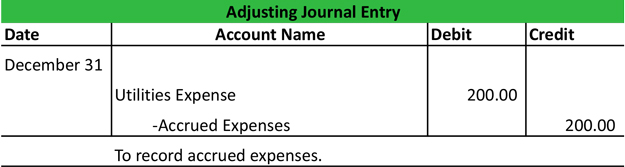

Adjusting Entries in Accounting Go to Adjusting Entries in Accounting Ch 6. The revenue is recognized through an accrued revenue account and a receivable account. Here are descriptions of each type plus example scenarios and how to make the entries.

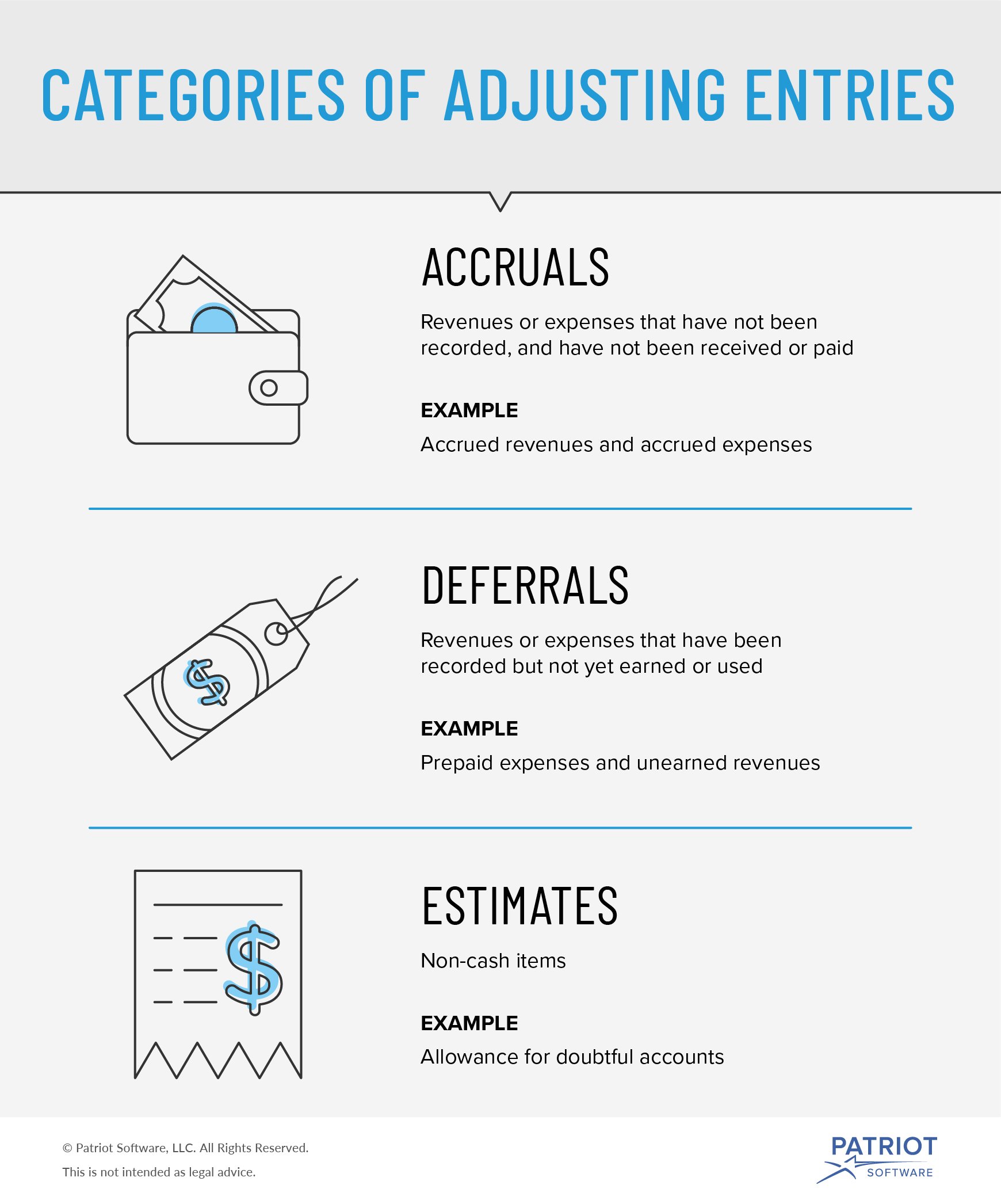

When goods are returned to supplier. If making adjusting entries is beginning to sound intimidating dont worrythere are only five types of adjusting entries and the differences between them are clear cut. Includes financial and managerial terms.

Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the right period in accord with the matching principle in accounting. When a cheque for 40200 is issued to the petty cashier the entries made in the main cash book are. This entry type is posted to shift ending to retain the earning account from all temporary accounts like loss gain expense and revenue account Revenue Account Revenue accounts are those that report the businesss income and thus have credit balances.

When expenses such as freight-in insurance etc. An accrued revenue is the revenue that has been earned goods or services have been delivered while the cash has neither been received nor recorded. Time Value of Money.

10 common types of errors in accounting. Journal entries in a perpetual inventory system. After adjusting the balances as per the bank and as per the books the adjusted amounts should be the same.

The non-base currency accounts are the accounts on the second and successive lines of a journal entry. In general there are two types of adjusting journal entries. When goods are purchased.

Once the balances are equal businesses need to prepare journal entries for the adjustments to the balance per books. If they are still not equal you will have to repeat the process of reconciliation again. 3 Cash Flow Mistakes That Nearly Upended a Profitable Growing Business.

3 Closing Entry. Customer paid 9000 in cash at the time of sale. When goods are sold to.

The department has three basic types of payroll accounting entries Accounting Entries Accounting Entry is a summary of all the business transactions in the accounting books including the debit credit entry. For the sake of our example Company XYZ adjusts their accounts at the end of every month through the double-entry bookkeeping method. 7 things to look for in accounting software.

A closing entry is a journal entry done at the end of the accounting period. Deferrals accruals tax adjustments and missing transaction. Now that we know the different types of adjusting entries lets check out how they are recorded into the accounting books.

Adjusting Entries Why Do We Need Adjusting Journal Entries. Types of Adjusting Journal Entries 1. There are four main types of adjustments.

Adjusting Entries And Accounting Treatment Journal Entries

Adjusting Entries Definition Types Examples Business Law Financial Statement Adjustable

Adjusting Entries Meaning Types Importance And More

Adjusting Entries Types Example How To Record Explanation Guide

Adjusting Entries Does Your Small Business Need Them

M 7f Adjusting Journal Entries Defined Journal Entries Accounting Accounting Education

0 Response to "5 Types of Adjusting Entries"

Post a Comment